Car title loan companies waiving traditional inspections offer faster cash access based on vehicle title value, benefiting borrowers with diverse vehicle conditions and limited credit options. However, this non-traditional method carries risks of misevaluated worth, higher interest rates, and repossession challenges for both parties. To mitigate these issues, thoroughly research reputable lenders with positive online reviews, proper licensing, transparent terms, and competitive rates, prioritizing a secure loan experience even for individuals with bad credit.

Looking for quick cash with your car as collateral? Discover car title loan companies that bypass traditional inspections, offering a hassle-free lending option. This article explores how these lenders operate, weighing the pros and cons of this alternative financing method. Learn crucial tips to select a reputable car title loan company, ensuring a smooth borrowing experience without the usual inspection hurdles.

- Understanding Car Title Loan Companies Without Inspection Requirements

- Advantages and Disadvantages of This Lending Model

- How to Choose a Reputable Lender Amidst Such Options

Understanding Car Title Loan Companies Without Inspection Requirements

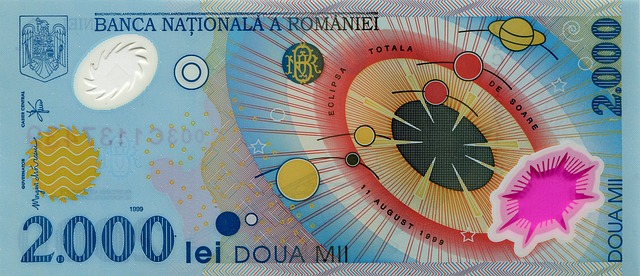

Car title loan companies that waive inspection requirements are changing the game for borrowers who need quick access to cash. In traditional loan scenarios, a thorough vehicle inspection is often mandatory, serving as a safeguard for lenders and a stringent process for borrowers. However, these innovative car title loan providers offer an alternative approach, assessing loan eligibility based on the value of the vehicle’s title rather than its physical condition. This shift simplifies the application process, eliminating the need for costly and time-consuming inspections.

By focusing on the title as collateral, lenders can provide faster funding, making it an attractive option for individuals in urgent financial situations. It’s particularly beneficial for those with vehicles that may not be in pristine condition but still hold significant value. This non-traditional lending method democratizes access to capital, ensuring that folks can tap into the equity of their vehicles without the usual barriers posed by strict vehicle inspection requirements.

Advantages and Disadvantages of This Lending Model

Car title loan companies that skip inspections offer a unique lending model with both benefits and drawbacks for borrowers. One advantage is speed and convenience; without the need for a thorough vehicle inspection, applicants can secure loans faster, making it an attractive option for those in urgent financial situations. This streamlined process allows car title loan companies to provide immediate funding, which can be particularly helpful when unexpected expenses arise or for individuals with poor credit who may struggle to qualify for traditional loans.

However, the absence of inspections also presents risks. Lenders rely on the value of the vehicle’s title as collateral, and without a proper assessment, they might not accurately gauge the car’s worth. This could lead to loan amounts that do not align with the vehicle’s actual market value, potentially causing borrowers to face higher interest rates or difficulty repaying the loan. Moreover, if the borrower defaults on payments, repossession may be more challenging since lenders lack a comprehensive understanding of the vehicle’s condition. Thus, while this model provides accessibility, it may also expose borrowers and lenders alike to increased financial vulnerabilities, especially in cases involving Houston title loans.

How to Choose a Reputable Lender Amidst Such Options

When considering a car title loan company that doesn’t require inspections, it’s paramount to conduct thorough research to ensure you choose a reputable lender. Start by checking online reviews and ratings from independent sources. Reviews offer valuable insights into the lending practices, customer service, and overall experience of previous borrowers. Look for companies with consistent positive feedback, as this indicates trustworthiness.

Additionally, verify the lender’s legitimacy by checking their licensing and registration with relevant financial authorities in your state. Reputable car title loan companies adhere to strict regulations, ensuring fair lending practices and consumer protection. Avoid lenders asking for excessive upfront fees or those that pressure you into rushed decisions. Opting for a lender offering transparent terms, competitive interest rates, and a straightforward application process is key to securing a favorable loan without stringent vehicle inspections, especially when considering bad credit loans.

Car title loan companies that waive inspection requirements offer a unique lending option, catering to those in need of quick cash. While this model has its benefits, such as streamlined processes and faster funding, it also presents risks, including higher interest rates and potential hidden fees. When choosing a lender, it’s paramount to verify their legitimacy, compare rates, and understand the terms to make an informed decision. Conducting thorough research is key to finding a reputable car title loan company that aligns with your financial needs without compromising your vehicle’s safety.