When considering car title loan companies, conduct thorough research to avoid predatory practices. Choose licensed, reputable lenders with transparent terms and online security. Understand loan details, including interest rates and repayment, and weigh flexibility against costs. Utilize online reviews and secure digital applications for enhanced safety and access to emergency funds.

In today’s financial landscape, car title loan companies have emerged as a fast and accessible option for borrowers. However, with numerous lenders in the market, it raises questions about trust and reliability. This article delves into the world of car title loan companies, providing insights on understanding their operations, considering key factors for trust, and exploring safety measures available to borrowers. By learning these aspects, individuals can make informed decisions when seeking car title loans.

- Understanding Car Title Loan Companies: The Basics

- Factors to Consider When Trusting These Lenders

- Safety Measures and Options for Borrowers Today

Understanding Car Title Loan Companies: The Basics

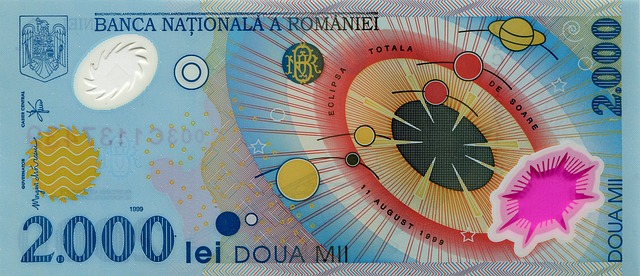

Car title loan companies have become a popular option for individuals seeking quick financial solutions. These businesses offer loans secured by a person’s vehicle, providing an alternative to traditional bank loans or credit cards. In simple terms, car owners can borrow money using their vehicles as collateral, and if they fail to repay the loan, the lender has the right to repossess the vehicle.

While the concept may seem straightforward, it’s essential to understand that not all car title loan companies operate with the same level of integrity. Many reputable lenders provide transparent services with fair interest rates and flexible repayment terms. Conversely, some less ethical companies may employ aggressive sales tactics, high-pressure environments, and hidden fees, making it crucial for borrowers to conduct thorough research and choose a trusted lender, such as Houston Title Loans, to ensure they receive a legitimate financial solution without facing any potential pitfalls or credit check hurdles.

Factors to Consider When Trusting These Lenders

When considering a car title loan from nationwide companies today, it’s crucial to assess several factors before entrusting your vehicle and financial information. Firstly, ensure that the lender is licensed and regulated by state authorities, as this guarantees they operate within legal boundaries and provides some protection against predatory lending practices. Secondly, verify their reputation by checking online reviews and feedback from previous borrowers; a reputable company should have a consistent track record of fair dealing.

Additionally, understand the terms and conditions of the loan, especially regarding interest rates, repayment schedules, and any potential penalties for early repayment or default. It’s also wise to inquire about the title transfer process and how it affects your vehicle ownership during and after the loan period. Some lenders may offer options for loan refinancing if circumstances change, providing flexibility but ensuring you grasp the associated costs and benefits before agreeing to any terms.

Safety Measures and Options for Borrowers Today

In today’s digital age, borrowers have access to a plethora of options when considering car title loan companies. This increased accessibility comes with its own set of benefits and challenges. To ensure safety, borrowers should look into reputable lenders who offer transparent terms and conditions, clear interest rate structures, and secure online application processes. Many legitimate car title loan companies now provide the option for an Online Application, allowing borrowers to apply from the comfort of their homes, a significant shift from traditional in-person loans. This digital transformation not only saves time but also enhances security measures by reducing the risk of personal information breaches.

Additionally, understanding your rights and options is crucial. Borrowers can take advantage of loan extension policies, which offer some flexibility if unexpected financial emergencies arise. However, it’s important to read the fine print and ensure that extensions do not trap you in a cycle of debt. Reputable car title loan companies today employ robust safety measures, including comprehensive customer support, secure data encryption for personal information, and fair lending practices, aiming to protect borrowers while providing them with access to emergency funds when needed.

In today’s digital age, navigating car title loan companies requires vigilance and an understanding of your rights. By being aware of the industry basics, considering key factors like lender reputation and terms, and leveraging safety measures, borrowers can make informed decisions. Remember that trust is paramount when borrowing against your vehicle, and with the right approach, you can find a reputable car title loan company offering fair terms and peace of mind.